UAE Macro Monitor

UAE Macro Monitor

UAE Macro Monitor Dashboard

Comprehensive overview of UAE's economic indicators and growth metrics

New Business Registrations

+14,392

Short Term Rental Units

28,754

Median Migrant Age

32.5 yrs

5G Subscribers

2.7M

Business Registration Growth

Business Growth Chart

(Chart visualization will appear here)

Rental Market Overview

Infrastructure Development

Energy Grid

+8.3%

↑2.1%Road Networks

+3.7%

↑0.5%5G Coverage

76%

↑12%Schools

+62

↑5.4%Tourism & Travel

New Flight Routes

+23142

+19.3% YoYPassenger Traffic

+1.8M12.4M

+15.2% YoYTaxi & Ride Services

+1,24526,890

+4.8% YoYOnline Content Growth

+28.7K156.2K

+22.5% YoYAI Content Generator

Generate visual data representations highlighting UAE's economic growth and investment opportunities.

Create professional brochures for promoting UAE business opportunities and lifestyle benefits.

Generate engaging social media content highlighting UAE's achievements and opportunities.

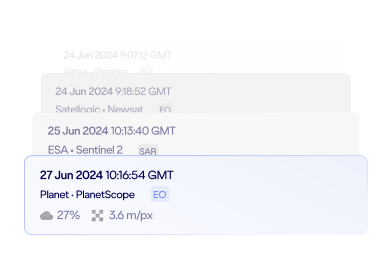

Recent Activity

Q2 2023 Real Estate Report Generated

2 hours ago

15 New Satellite Images Processed

Yesterday at 4:30 PM

New Content Generated: Dubai Business Setup Guide

2 days ago

Alert: Significant Increase in 5G Subscribers

3 days ago

Upcoming Data Updates

Monthly Economic Report

Federal Competitiveness and Statistics Centre

Quarterly Tourism Statistics

Dubai Tourism

Banking & Finance Data

Central Bank of UAE

New Satellite Imagery

SpaceKnow & Planet Labs

Real Estate

Comprehensive insights into UAE's real estate market trends and growth

Short-term Rental Units

28,754

Occupancy Rate

86.2%

Long-term Rental Growth

4.2%

New Construction Units

12,840

Rental Market Trends

Rental Market Trends Chart

(Chart visualization will appear here)

Emirates Comparison

* Rental growth rates (YoY) for short-term rentals

Construction Activity

73%

Active Sites

+12%

YoY

142

New Sites

Residential

68 sites

+8.2%Commercial

42 sites

+5.7%Retail

23 sites

+3.1%Hospitality

17 sites

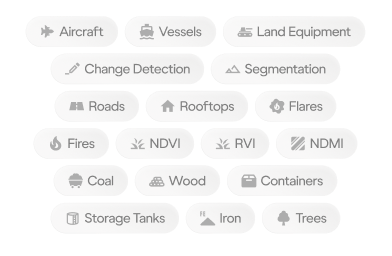

+1.2%Data source: SpaceKnow Satellite Imagery Analysis

Short-term Rental Distribution

Property Type Distribution Chart

(Pie chart will appear here)

Detailed Market Data

| Emirate | Total Units | Occupancy Rate | Avg. Daily Rate | YoY Growth | Under Construction |

|---|---|---|---|---|---|

| Dubai | 16,842 | 89.7% | AED 785 | +9.7% | 6,240 |

| Abu Dhabi | 7,458 | 82.4% | AED 650 | +7.2% | 3,120 |

| Sharjah | 2,156 | 78.5% | AED 480 | +5.8% | 1,540 |

| Ras Al Khaimah | 1,243 | 76.2% | AED 520 | +4.3% | 840 |

| Ajman | 621 | 72.8% | AED 420 | +3.9% | 560 |

Showing 5 of 7 emirates

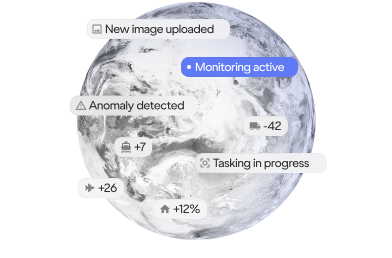

Satellite Imagery Analysis

Dubai Marina Development

Construction progress monitoring shows 87% completion rate, up 12% from previous quarter.

Abu Dhabi Waterfront Project

New residential development shows significant progress with 62% completion, ahead of projected timeline.

Sharjah Commercial District

Satellite analysis shows 14 new commercial properties under construction, a 28% increase from last year.

Imagery analysis provided by SpaceKnow, Satelligence Labs, and Planet Labs

Market Intelligence AI Insights

Rental Market Growth Insight

Short-term rental market growth in Dubai has outpaced all other emirates by 2.5%, primarily driven by tourism recovery and digital nomad visa programs.

Investment Opportunity Alert

AI analysis identifies Ras Al Khaimah waterfront properties as high-potential investment areas with projected 12% ROI over the next 24 months.

Market Trend Analysis

Satellite imagery analysis shows 28% of new construction is focused on eco-friendly and sustainable housing, indicating a shift in consumer preferences.

Last updated: June 15, 2023

Business Metrics

Comprehensive insights into UAE's business landscape and economic growth

New Business Registrations

14,392

Foot Traffic Growth

+18.7%

Job Postings

27,845

New Bank Accounts

86,521

Business Registrations by Sector

Business Registrations Chart

(Chart visualization will appear here)

New Businesses by Size

Total: 14,392

12.4% YoYJob Market Overview

Total Job Postings

27,845

+9.8%Average Salary

AED 12,450

+4.3%Time to Fill

18 days

-2.4 daysApplication Rate

42 per post

+6.2%Top Growing Job Sectors

Data source: TalentNeuron

Digital & Online Presence

Web Traffic to UAE Domains

Total Visits

142.3M

+18.2% YoY

Avg. Duration

4:32 min

+0:48 YoY

Bounce Rate

38.4%

-2.7% YoY

Top Traffic Sources by Country

UAE Online Content Growth

+24.3K posts

YouTube

+5.7K videos

+18.9K articles

News Articles

+12.4K mentions

Data sources: Ahrefs, SpyFu, Google Analytics

Banking & Finance Metrics

New Brokerage Accounts

Across all financial institutions

Bank Deposit Volumes

Total deposits across UAE banks

Financial Services Growth

New financial service providers

| Emirate | New Businesses | Bank Deposits | Financial Services | YoY Growth | Trend |

|---|---|---|---|---|---|

| Dubai | 8,471 | AED 425B | 384 | +14.7% | |

| Abu Dhabi | 3,842 | AED 302B | 246 | +11.2% | |

| Sharjah | 1,254 | AED 98B | 82 | +7.8% | |

| Other Emirates | 825 | AED 69B | 52 | +5.3% |

Data source: UAE Central Bank, Federal Competitiveness and Statistics Centre

Business Trend Analysis & Insights

Technology Sector Growth Accelerating

The UAE's technology sector is showing robust 24.5% YoY growth, with Dubai Silicon Oasis and Abu Dhabi's Hub71 attracting 142 new tech startups in the last quarter alone.

Financial Services Ecosystem Expanding

The 12.8% increase in financial service providers, coupled with the 24.3% growth in brokerage accounts, indicates strong investor confidence in UAE's financial market stability.

Digital Content & Online Engagement Surge

The 18.2% growth in web traffic to UAE domains, alongside substantial increases in social media content about UAE business opportunities, signals strong global interest in UAE market entry.

SME Growth Driving Economic Diversification

Small and medium enterprises account for 86% of new business registrations, highlighting the success of UAE's entrepreneurship-friendly policies and the diversification away from oil dependency.

Tourism Data

Comprehensive insights into UAE's tourism market and visitor trends

Visitor Arrivals

16.73M

New Flight Routes

48

Tourist Spending

$29.4B

Average Stay

5.8 days

Visitor Arrivals Trend

Visitor Arrivals Trend Chart

(Chart visualization will appear here)

Top Source Countries

Total Visitors: 16.73M

Transportation Metrics

Taxi Fleet

11,248

+8.3%Ride-Sharing

8,752

+22.6%Metro Ridership

219M

+15.4%E-Scooters

4,250

+64.8%Ride Activity vs. Tourist Arrivals

Correlation Chart

Data sources: Dubai Roads and Transport Authority, Abu Dhabi Department of Transport

Flight Data & Connectivity

International Flights

Total Routes

324

+48 YoY

Airlines

98

+12 YoY

Passenger Count

84.5M

+18.7% YoY

Top Growing Routes

New Routes Added (Last 12 Months)

World Map Visualization

Data sources: Civil Aviation Authority, UAE Airports

Tourist Activities & Spending

Spending Categories

Spending Category Chart

Popular Activities

Spending by Visitor Origin

Chinese Tourists

$2,845

avg. spend per visitUK Tourists

$2,380

avg. spend per visitRussian Tourists

$2,170

avg. spend per visitUS Tourists

$2,095

avg. spend per visitSaudi Tourists

,980

avg. spend per visit| Emirate | Visitor Share | Avg. Length of Stay | Avg. Spend Per Day | YoY Growth | Top Activity |

|---|---|---|---|---|---|

| Dubai | 68.4% | 6.2 days | $348 | +16.2% | Shopping |

| Abu Dhabi | 21.3% | 5.8 days | $306 | +12.7% | Cultural Visits |

| Sharjah | 5.8% | 4.5 days | $224 | +8.3% | Museums |

| Ras Al Khaimah | 2.7% | 4.2 days | $278 | +18.4% | Adventure |

| Other Emirates | 1.8% | 3.6 days | 95 | +5.9% | Local Experiences |

Data source: Department of Tourism and Commerce Marketing, UAE Tourism Authorities

Mobile Analytics & Foot Traffic

Tourist Mobility Heatmap

Heatmap Visualization

Most Active Area

Dubai Mall & Downtown

+28.7% YoY

Fastest Growing Area

Dubai Marina

+34.2% YoY

Peak Activity Time

5:00 PM - 9:00 PM

+1.2 hrs longer vs 2022

Peak Day of Week

Friday

36% of weekly activity

Mobile Data Insights

International Roaming Data Usage

Geolocation Check-ins

Top Location

Burj Khalifa

4.2M check-ins

Rising Popularity

Museum of the Future

+128% YoY

Connection Security

Data sources: Etisalat, Du, Global Media Insight

Last updated: June 18, 2023

Infrastructure

Comprehensive insights into UAE's infrastructure development and growth

Energy Grid Growth

+8.3%

Road Network Growth

+3.7%

5G Coverage

76%

Schools Growth

+62

Energy Grid & Connectivity Trends

Energy Grid & Connectivity Trends Chart

(Chart visualization will appear here)

Energy Capacity

42.8 GW

+8.3% YoY

5G Subscribers

2.7M

+42.3% YoY

Data Consumption

4.8 EB

+24.6% YoY

Emirates Infrastructure Comparison

* Infrastructure development index based on energy, connectivity, transportation, and education metrics

Transportation Infrastructure

Roads (km)

14,820

+3.7%Taxi Fleet

11,248

+8.3%Metro Lines (km)

162

+12.5%ATMs

5,820

+4.2%Port Traffic Growth

Port Traffic Bar Chart

Data sources: Roads and Transport Authority, UAE Ports Authorities

Education Infrastructure

Schools Growth

Total Schools

1,243

+62 YoY

Public Schools

732

+28 YoY

Private Schools

511

+34 YoY

Technical Education Growth

Technical Schools

92

+14 YoY (+17.9%)

Universities/Colleges

86

+7 YoY (+8.9%)

Student Enrollment Growth

Student Enrollment Line Chart

Data sources: Ministry of Education, UAE Education Council

Advanced Infrastructure Analytics

Night-time Lights Data

Night Lights Heatmap

(Visualization will appear here)

Light Intensity Growth

+18.4%

Over past 12 months

Urbanization Indicator

86.3%

Based on light patterns

Data source: NASA Earthdata, World Bank (LEN dataset)

Satellite Construction Analytics

Construction Activity Map

(Visualization will appear here)

Active Construction Sites

1,287

+12.4% YoY

Infrastructure Projects

428

+16.8% YoY

Data source: SpaceKnow, Satelligence Labs, Planet Labs

Digital Infrastructure

5G Penetration Rate

Data Center Growth

Smart City Initiatives

Energy & Utilities Growth

Electricity Consumption

Renewable Energy Capacity

Water Infrastructure

Data sources: Federal Competitiveness and Statistics Centre (FCSC) UAE, DEWA, IEA

Infrastructure Growth Forecast

Energy

12-month forecast based on current trends

Digital

12-month forecast based on current trends

Transport

12-month forecast based on current trends

Key Projects Timeline

Q3 2023

Dubai Metro Expansion

Q4 2023

5G Full Coverage

Q1 2024

Smart Grid Phase 2

Q2 2024

Abu Dhabi Port Expansion

Q3 2024

Solar Park Phase 4

Investment Forecast

Investment Bar Chart

(Visualization will appear here)

Infrastructure AI Insights

5G Deployment Advantage

UAE's 5G coverage at 76% is now 18% higher than the global average, providing a strong foundation for next-generation digital services.

Renewable Energy Growth

Satellite imagery analysis shows a 42.6% increase in solar installation area in the past 12 months, accelerating the UAE's clean energy transition.

Education Infrastructure

The 17.9% growth in technical schools significantly outpaces the global average of 6.2%, positioning UAE as a growing hub for technical education and innovation.

Financial Indicators

Comprehensive data dashboard monitoring key economic metrics across the UAE to drive informed decision-making and business growth.

Data Categories

Data Sources

Time Period

Real Estate Metrics Dashboard

Global satellite imagery analysis showing UAE construction activity

Short-Term Rentals

+12.8%28,492

Total Available Units

New Business Registrations

+9.3%4,721

Last Quarter

Flight Routes to UAE

+7.5%312

Active International Routes

5G Subscribers

+32.1%3.2M

Active Subscribers

Emirates Filter

AI-Generated Marketing Content

UAE Business Growth Infographic

Shareable statistics highlighting 5-year business growth trends across all Emirates.

Investment Opportunities Brochure

Comprehensive guide highlighting emerging sectors and investment avenues in UAE.

Social Media Campaign Kit

Ready-to-use posts highlighting UAE's growth across platforms with optimal posting schedule.

Target Audience

Output Format

Languages

Powered by Leading Data Sources

Digital Trends

Track UAE's digital ecosystem growth with comprehensive analytics on connectivity, online presence, and technological advancement.

Digital Metrics

Emirates Filter

Time Period

Telecom & Connectivity Metrics

Tracking mobile network usage, internet adoption, and digital infrastructure growth

5G Subscribers

4.8M

Data Consumption

1.7PB

Internet Penetration

98.5%

Tech Workforce

142K

Mobile Data Consumption Trend (Petabytes)

Data consumption increased by 42.8% year-over-year

Telecom Provider Market Share

Providers

UAE Online Content Growth

Developer Tools & Tech Stack Adoption

| Tool/Platform | Traffic Growth | Adoption Rate | YoY Change |

|---|---|---|---|

| GitHub |

▲ 68.2%

|

|

+12.4% |

| Cursor AI |

▲ 91.7%

|

|

+27.8% |

| AWS Services |

▲ 52.3%

|

|

+9.2% |

| VS Code |

▲ 45.9%

|

|

+5.7% |

AI-Generated Insights

Key trends and opportunities from the latest digital data analysis

5G Adoption Insight

UAE's 5G subscriber growth rate of 37.2% outpaces global average by 2.8x, creating new opportunities for IoT and smart city technologies.

Content Opportunity

Analysis shows 62% YoY growth in "How to" UAE content on YouTube, with business formation and relocation topics generating highest engagement.

Tech Workforce Trend

18.7% growth in tech hiring, with 142K professionals now working in UAE's digital sector. Software development and AI roles show strongest demand.

Data sources: Etisalat, Du, Global Media Insight, Federal Competitiveness and Statistics Centre (FCSC) UAE

Last data update: June 15, 2023

Content Generator

Transform UAE's positive growth data into compelling marketing materials in 200+ languages to drive business opportunities and investments.

AI Content Generator

Select data metrics, target audience, and content type to create powerful marketing materials that highlight UAE's growth.

Recent Generations

Real Estate Growth Infographic

Generated 3 days ago

Dubai Tourism Brochure

Generated 1 week ago

Social Media Campaign Kit

Generated 2 weeks ago

Content Preview

UAE Investment Landscape 2023

Unprecedented Growth & Opportunity

Real Estate Growth by Emirate

Key Growth Indicators

Why UAE Is The Prime Investment Destination

Template Style

Content Generation Examples

UAE Business Growth

Interactive Infographic

Business Growth Infographic

Visual representation of UAE's exponential business growth with sector-by-sector analysis and opportunity highlights.

Relocation Guide

Digital & Print Brochure

Corporate Relocation Guide

Comprehensive guide for businesses looking to relocate to UAE, featuring regulatory information and incentives.

YouTube

Tourism Social Media Kit

Ready-to-use social media posts featuring UAE tourism growth statistics and destination highlights across all platforms.

Sourced from Reliable Data Partners

Federal Competitiveness and Statistics Centre

Dubai Electricity and Water Authority

Etisalat & Du Global Media Insights

NASA Earthdata & World Bank (LEN dataset)

Distribution Options

Schedule your content to be distributed to your partners, clients, or prospects automatically.

Settings

Customize your UAE Macro Monitor experience and manage data sources, integrations, and user preferences.

Settings

Account Settings

Ahmed Al Mansouri

Enterprise Account

Data Source Settings

Real Estate Data

Short and long-term rental metrics

Last Updated

Today, 09:45 AM

Refresh Frequency

Daily

Data Source

Dubai Land Department API

Business Registration Data

New business registrations by sector and size

Last Updated

Yesterday, 14:20 PM

Refresh Frequency

Weekly

Data Source

Department of Economic Development

Satellite Imagery

Construction activity monitoring

Last Updated

3 days ago

Refresh Frequency

Bi-weekly

Data Source

SpaceKnow, Planet Labs

API Access

API Keys

Production Key

Development Key

Access Permissions

API Usage

You've used 65% of your monthly API quota

Resets in 8 days